2025 Tax Deadline: What You Need to Know About Filing Your Taxes

BlogTable of Contents

- Tax Due Date 2025 - Laura Olivia

- Tax Day 2024 Deadline: When is the Last Day to File Your Taxes ...

- Business Tax Deadlines 2025: Corporations and LLCs

- 2025 Tax Filing Deadline California - Taylor Casey

- Tax Due Date 2025 - Laura Olivia

- Bir Tax Calendar 2025 Pdf - Mark M. Hassan

- Tax Due Date 2025 - Laura Olivia

- 2025 Tax Extension Deadline 2025 Olympics - Karen Smith

- Why CPA need Outsourcing Tax Preparation Services?

- Tax Due Date 2025 - Laura Olivia

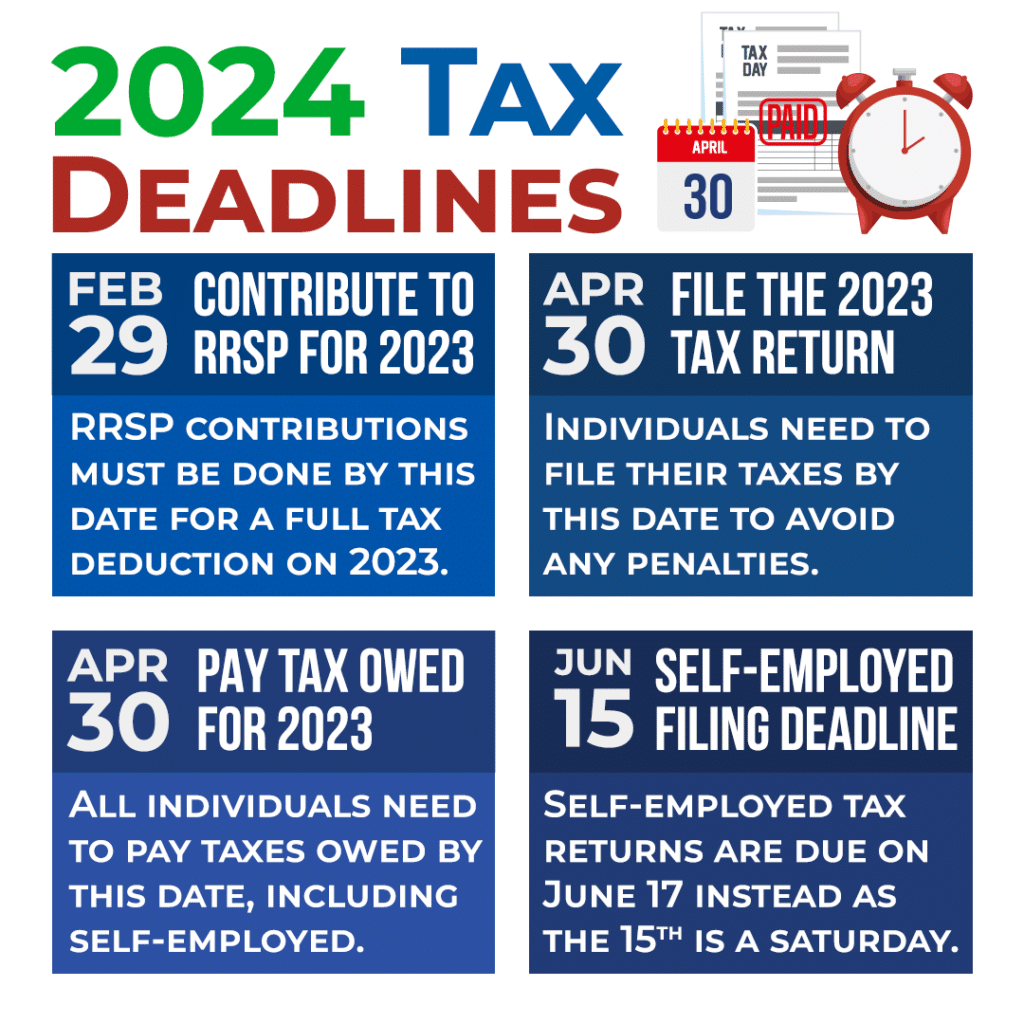

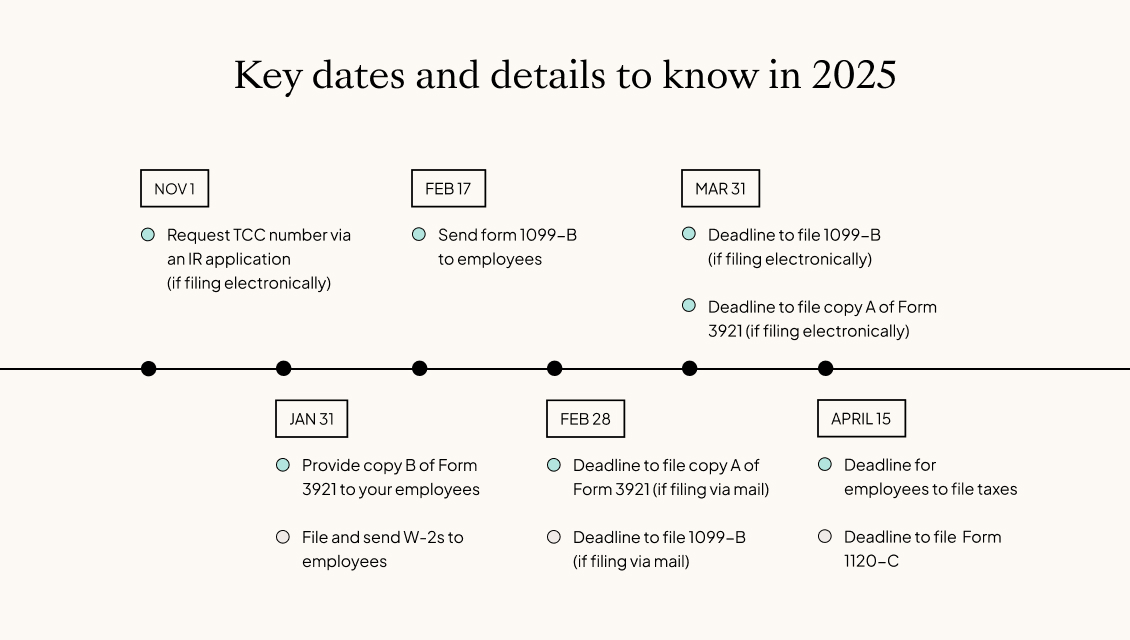

When is the 2025 Tax Deadline?

What Do I Need to File?

How Do I File My Taxes?

There are several ways to file your taxes, including: E-filing through the IRS website or tax software like TurboTax or H&R Block Mailing your tax return to the IRS Visiting an IRS office or tax preparation service The IRS recommends e-filing, as it's faster and more accurate than mailing your return.

What Happens if I Miss the Deadline?

If you miss the April 15 deadline, you may face penalties and interest on any taxes you owe. The IRS charges a late filing penalty of 5% of the unpaid taxes for each month or part of a month, up to 25%. You may also be charged interest on any unpaid taxes. However, if you need more time to file your taxes, you can file for an extension by April 15. This will give you an additional six months to file your return, but you'll still need to pay any taxes you owe by the original deadline to avoid penalties and interest. The 2025 tax deadline is April 15, 2025, and it's essential to mark your calendars to avoid any last-minute rushes or penalties. Make sure to gather the necessary documents, report any changes to your income, and file your taxes on time. If you need more time, you can file for an extension, but be sure to pay any taxes you owe by the original deadline. By following these tips, you can ensure a smooth and stress-free tax filing experience.Source: NBC New York

Note: The article is written in HTML format with header tags (h1, h2) and bold text to highlight important information. The article is also optimized with relevant keywords, such as "2025 tax deadline" and "IRS", to improve search engine ranking.