As the year 2026 approaches, it's essential to start thinking about Medicare IRMAA (Income-Related Monthly Adjustment Amount) tax planning. IRMAA is a surcharge applied to Medicare Part B and Part D premiums for individuals with higher incomes. The good news is that with proactive planning, you can minimize your IRMAA liability and reduce your Medicare costs. In this article, we'll explore the importance of 2026 Medicare IRMAA tax planning and provide valuable insights to help you get started.

Understanding IRMAA and Its Impact on Medicare Costs

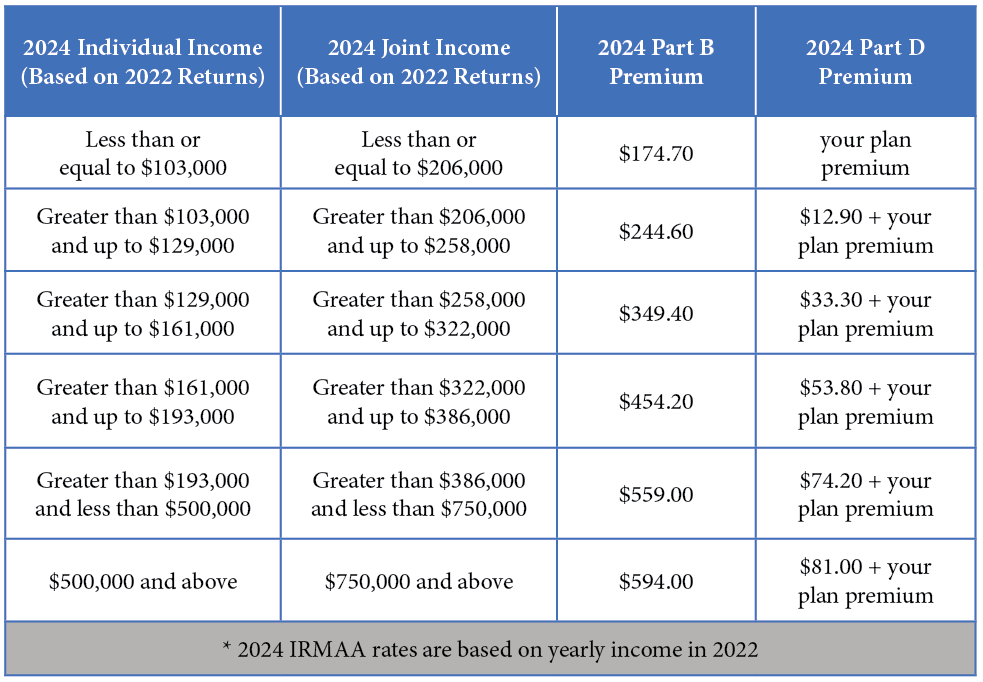

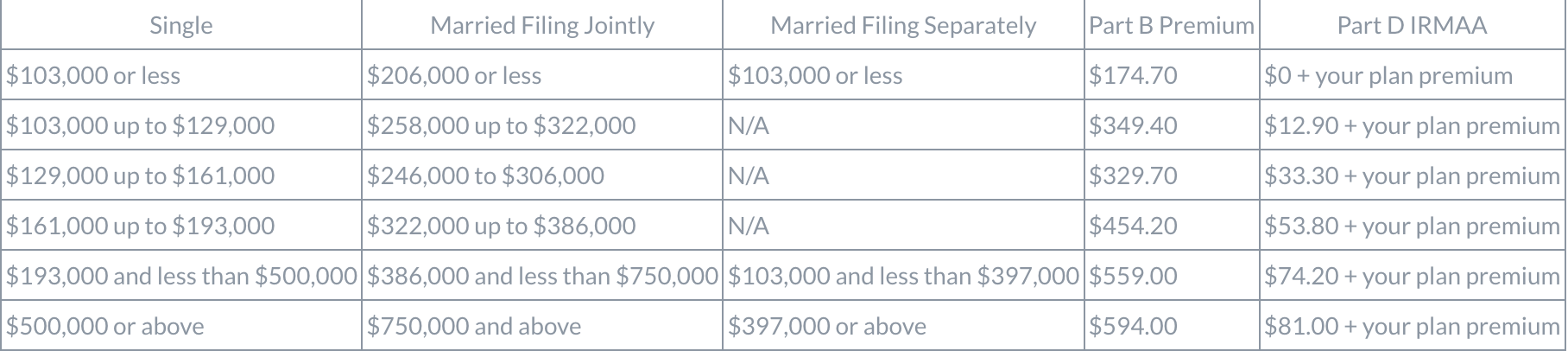

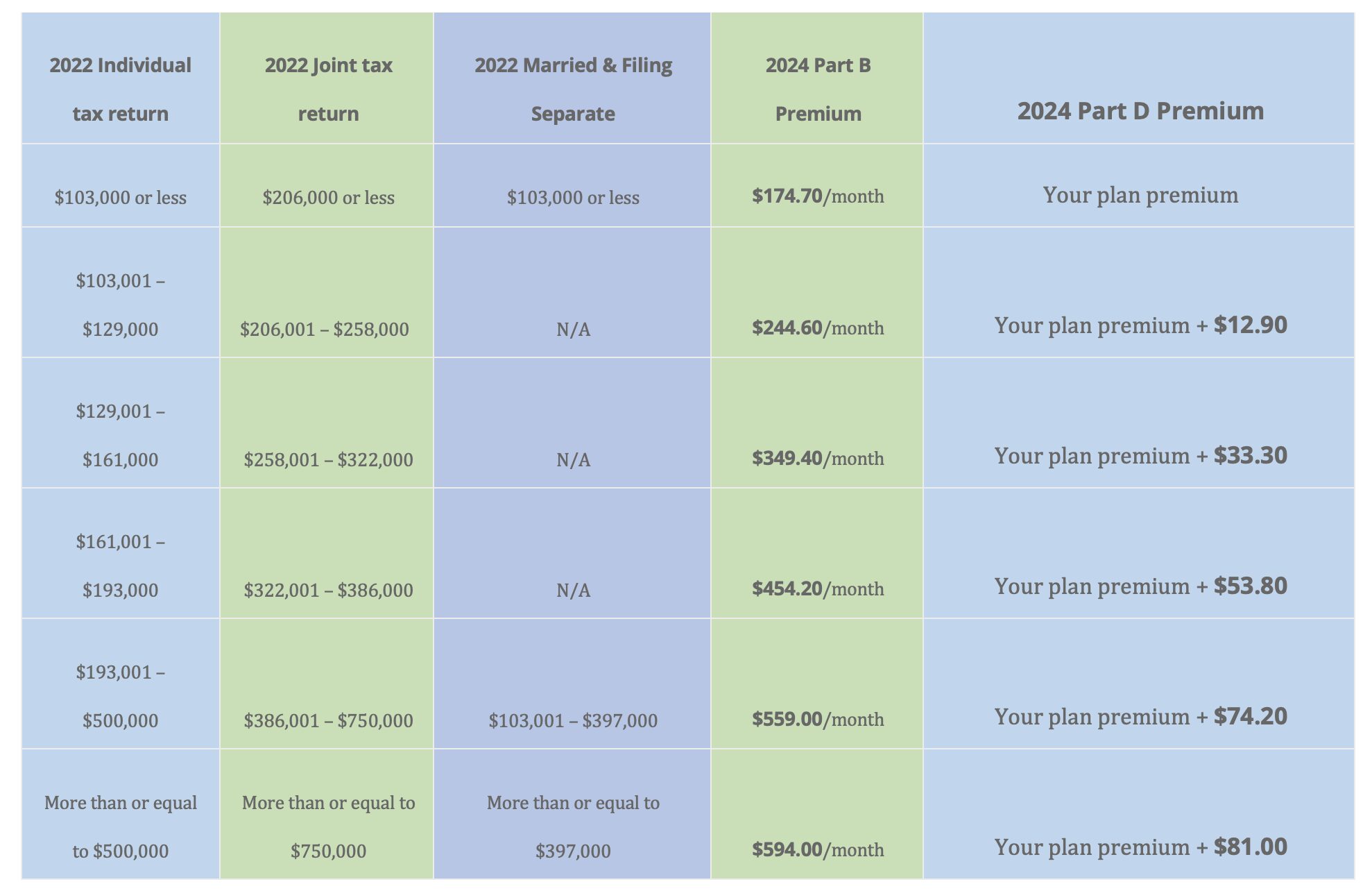

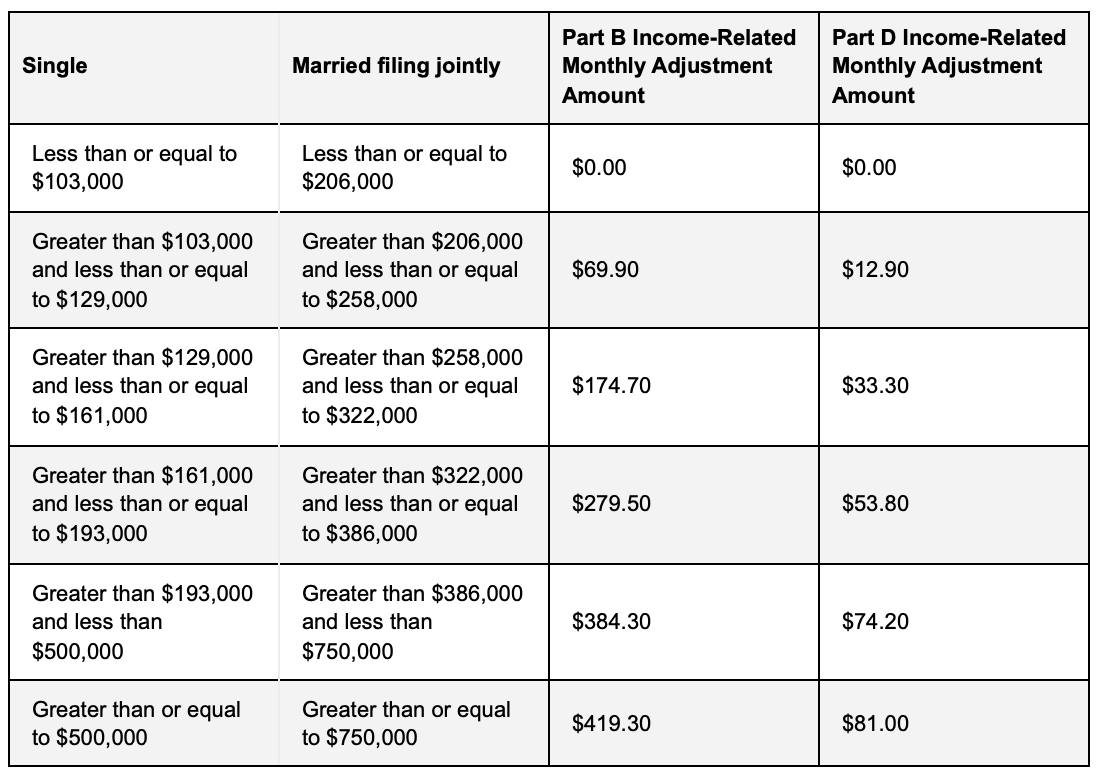

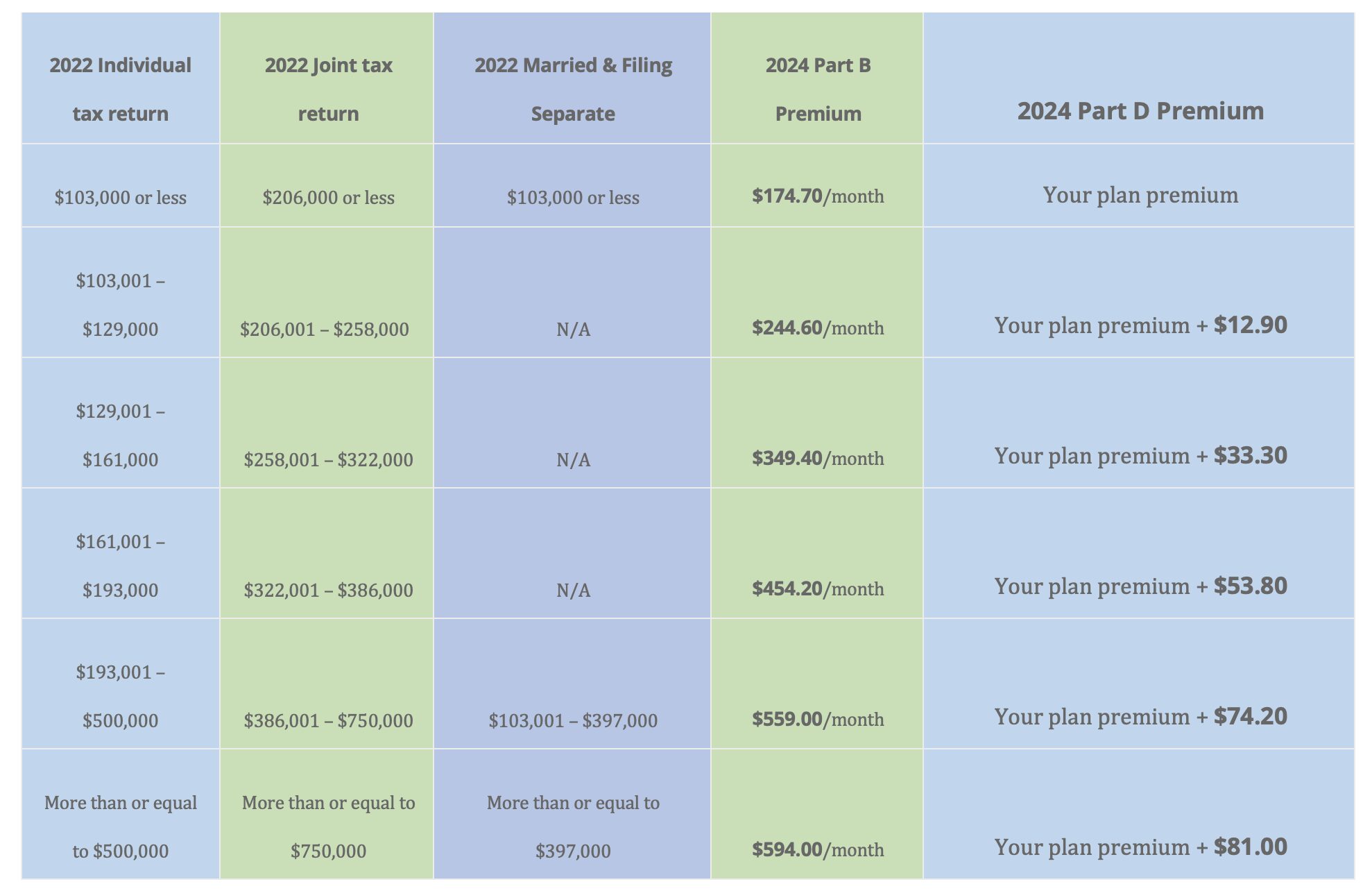

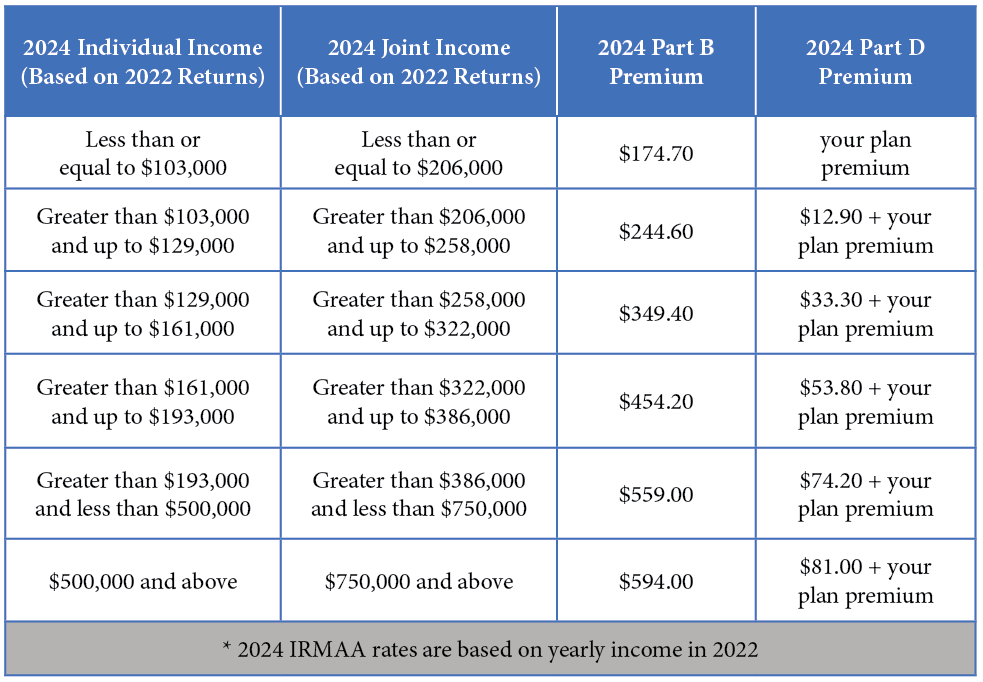

IRMAA is a surcharge that's applied to Medicare Part B and Part D premiums based on an individual's modified adjusted gross income (MAGI). The surcharge is designed to ensure that higher-income individuals contribute more to the Medicare program. The IRMAA surcharge can significantly increase your Medicare costs, with the highest surcharge adding over $300 to your monthly premium.

Why 2026 Medicare IRMAA Tax Planning is Crucial

The IRS uses your tax return from two years prior to determine your IRMAA surcharge. This means that your 2024 tax return will be used to determine your 2026 IRMAA surcharge. By planning ahead, you can take steps to reduce your MAGI and minimize your IRMAA liability. This can result in significant cost savings and help you avoid unexpected increases in your Medicare premiums.

Strategies for Minimizing IRMAA Liability

There are several strategies you can use to minimize your IRMAA liability:

Convert traditional IRAs to Roth IRAs: Converting traditional IRAs to Roth IRAs can help reduce your MAGI and minimize your IRMAA surcharge.

Harvest investment losses: Selling investments that have declined in value can help offset gains from other investments and reduce your MAGI.

Delay income: Delaying income, such as retirement account distributions or capital gains, can help reduce your MAGI and minimize your IRMAA surcharge.

Consider a qualified charitable distribution (QCD): Making a QCD from your IRA can help reduce your MAGI and minimize your IRMAA surcharge.

Seeking Professional Guidance

While these strategies can help minimize your IRMAA liability, it's essential to seek professional guidance to ensure you're making the most effective decisions for your individual situation. A financial advisor or tax professional can help you navigate the complex rules and regulations surrounding IRMAA and provide personalized guidance on reducing your Medicare costs.

2026 Medicare IRMAA tax planning is a critical step in minimizing your liability and reducing your Medicare costs. By understanding how IRMAA works and using proactive strategies to reduce your MAGI, you can avoid unexpected increases in your Medicare premiums. Don't wait until it's too late – start planning now and take control of your Medicare costs. With the right guidance and planning, you can ensure a more secure and affordable retirement.

Note: This article is for informational purposes only and should not be considered as tax or financial advice. It's essential to consult with a financial advisor or tax professional to determine the best course of action for your individual situation.