Interest Rate Outlook 2024: What to Expect from the Federal Reserve

BlogTable of Contents

- Proyeksi Pertumbuhan Ekonomi Indonesia 2024 | Republika Online

- US Dollar Advances as Fed Pause Unlikely. Forecast as of 14.11.2024 ...

- Schroders Indonesia Outlook 2024: Makroekonomi

- Fed Rate Cut Date 2024: How December 18 Decision Could Shape the Crypto ...

- Inflation and monetary policy outlook for 2024

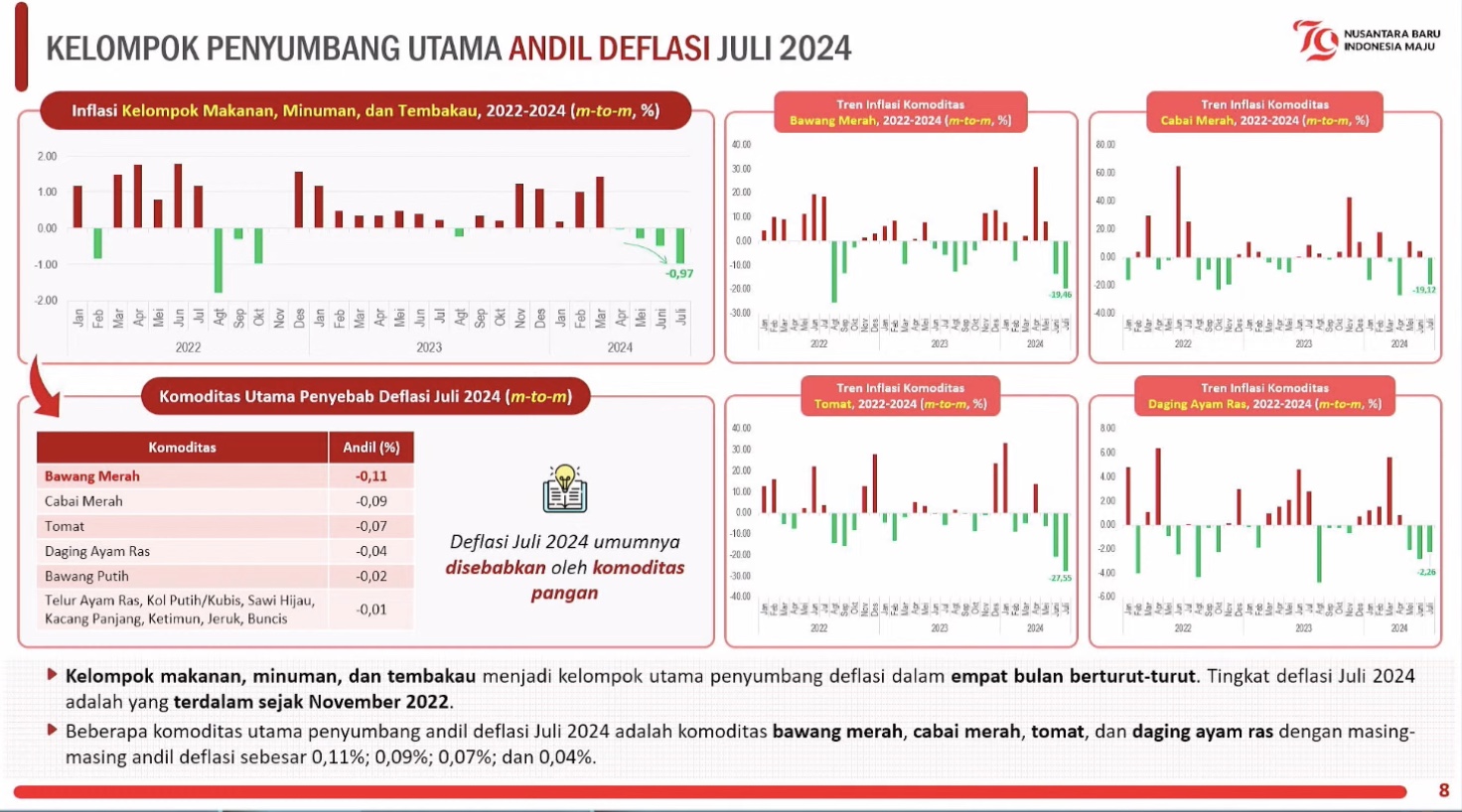

- Indonesia Deflasi 0,18 Persen Juli 2024, Makanan hingga Tembakau jadi ...

- Investment bank bullish on Fed rate cuts; inflation concerns linger ...

- New Estimate Says Fed Will Cut Interest Rates Starting in 2024 - RetailWire

- US Fed Raises Interest Rate by 0.5%; No Reduction till 2024 - Coin Edition

- 17.04.2024: Fed to lag behind major central banks in rate cuts? (S&P ...

The Federal Reserve, led by Chairman Jerome Powell, has been on a mission to combat inflation and stabilize the economy. In 2022, the Fed raised interest rates aggressively, with seven rate hikes in a single year. This move was aimed at curbing inflation, which had reached a 40-year high. However, with inflation showing signs of slowing down, the question on everyone's mind is: will the Fed continue to raise interest rates in 2024?

Current Economic Conditions

According to Bankrate, the Fed's decision to raise interest rates again in 2024 will depend on various economic factors, including inflation, employment, and GDP growth. If these factors indicate that the economy is still growing strongly, the Fed may consider raising interest rates to prevent the economy from overheating. However, if the economy shows signs of slowing down, the Fed may decide to keep interest rates steady or even lower them.

Impact on Consumers

- Higher mortgage rates, making it more expensive to buy or refinance a home

- Higher credit card APRs, increasing the cost of carrying credit card debt

- Higher interest rates on personal loans and lines of credit

- Lower mortgage rates, making it more affordable to buy or refinance a home

- Lower credit card APRs, reducing the cost of carrying credit card debt

- Lower interest rates on personal loans and lines of credit

Stay tuned for more updates on the Federal Reserve's interest rate decisions and how they may impact your finances. In the meantime, you can visit Bankrate for the latest news and analysis on interest rates and personal finance.