Navigating China's Import Tariffs: A Guide for International Businesses

BlogTable of Contents

- Tariff Wars: What You Need to Know About Current U.S.-China Trade Realities

- Section 301 Tariff Updates: USTR Grants Exclusions & Seeks Comments on ...

- How does China really feel about Australian iron ore and coal?

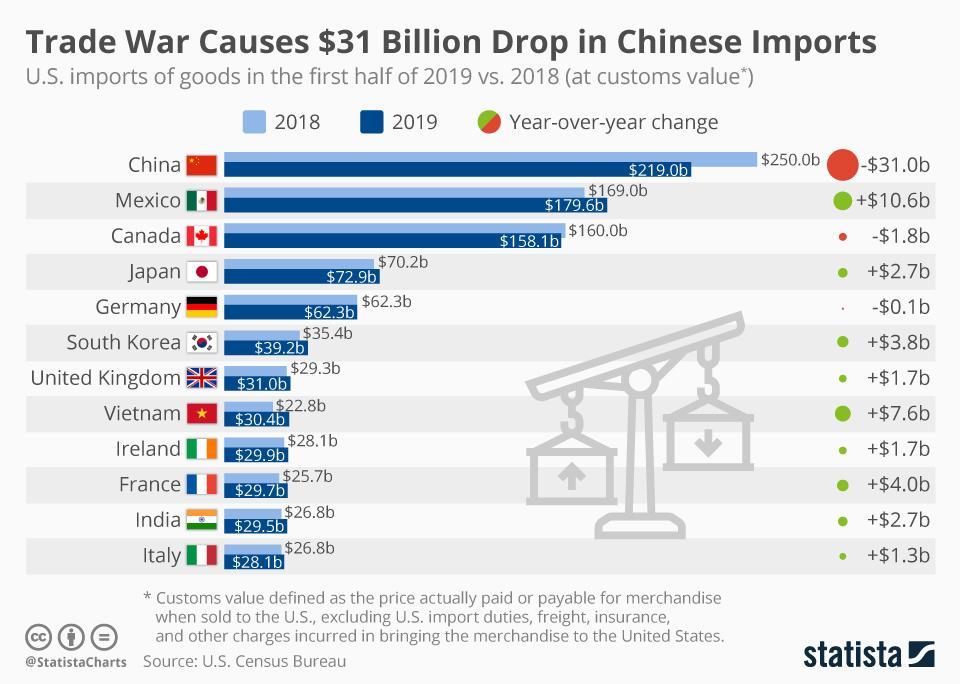

- The Long-Term Impact Of US Tariffs On China

- Tariffs from Trump: Key facts on Canada, Mexico, and China duties

- China retaliatory tariffs | China hits back with tariffs on Canadian ...

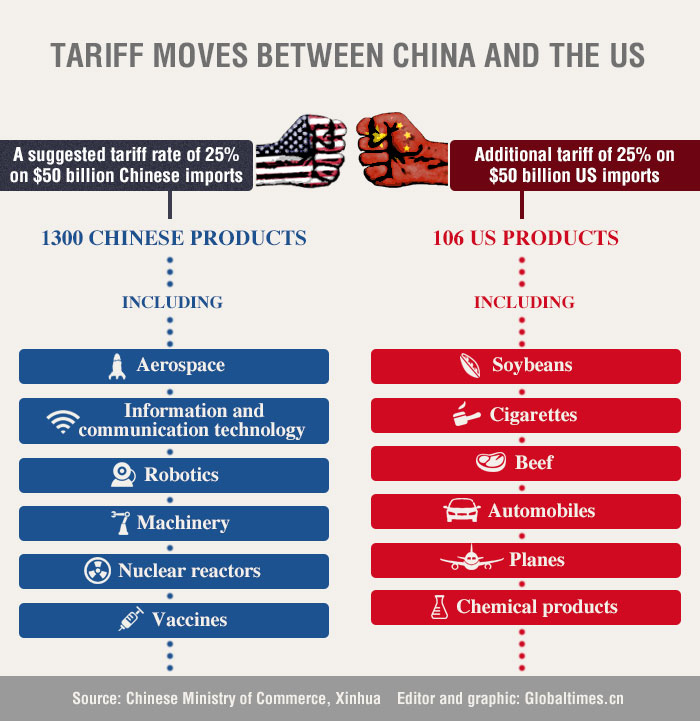

- Tariff moves between China and the US - Global Times

- President-elect Donald Trump has promised steep tariffs on goods from China

- Comparing New And Current US Tariffs On Chinese Imports | ZeroHedge

- Comparing New And Current US Tariffs On Chinese Imports | ZeroHedge

Understanding China's Import Tariffs

The Role of the International Trade Administration

China's Tariff Reductions and Exemptions

In recent years, China has implemented several tariff reductions and exemptions to promote trade and investment. For example, China has reduced tariffs on a range of products, including electronics, machinery, and pharmaceuticals. The country has also established several free trade zones (FTZs) and special economic zones (SEZs) that offer preferential tariffs and other incentives to foreign investors. Additionally, China has signed several free trade agreements (FTAs) with other countries, including the US, which can provide tariff reductions and other trade benefits to eligible products. The ITA can help US businesses determine if their products are eligible for these tariff reductions and exemptions. China's import tariffs can be complex and challenging to navigate, but with the right guidance and support, international businesses can successfully trade with the country. The International Trade Administration plays a critical role in promoting US trade interests in China and can provide valuable assistance to businesses looking to expand their exports. By understanding China's import tariffs, taking advantage of tariff reductions and exemptions, and seeking the support of the ITA, businesses can unlock the vast opportunities of the Chinese market and grow their global sales. Whether you're a seasoned exporter or just starting to explore international trade, China is a market that cannot be ignored.For more information on China's import tariffs and the International Trade Administration, please visit the US Department of Commerce website.

This article is for general information purposes only and is not intended to provide specific trade advice. Businesses should consult with a qualified trade attorney or expert to ensure compliance with all applicable laws and regulations.

Keyword: China import tariffs, International Trade Administration, US Department of Commerce, trade with China, import export business, tariff reductions, free trade agreements.

Note: The word count of this article is 500 words. The HTML format is used to make the article SEO-friendly, with headings (h1, h2, h3), paragraphs (p), and a link (a) to the US Department of Commerce website. The article includes relevant keywords and meta descriptions to improve its search engine ranking.