Understanding Required Minimum Distributions for IRA Beneficiaries: A Guide

BlogTable of Contents

- Ira Minimum Distribution Table 2017 | Review Home Decor

- What are Required Minimum Distributions (RMDs)?

- What new IRA distribution tables mean for you | Business ...

- inherited ira distribution table | Brokeasshome.com

- Required Minimum Distribution Table For Inherited Ira | Elcho Table

- The IRA Distribution Table: 3 Must-Know Tips | The Motley Fool

- What new IRA distribution tables mean for you | Business ...

- Required Minimum Distribution Table Spouse 10 Years Younger | Elcho Table

- Inherited Ira Distribution Table | Brokeasshome.com

- PPT - IRAs: Traditional vs. Roth PowerPoint Presentation, free download ...

What are Required Minimum Distributions?

Who is Affected by RMDs?

Key Concepts for IRA Beneficiaries

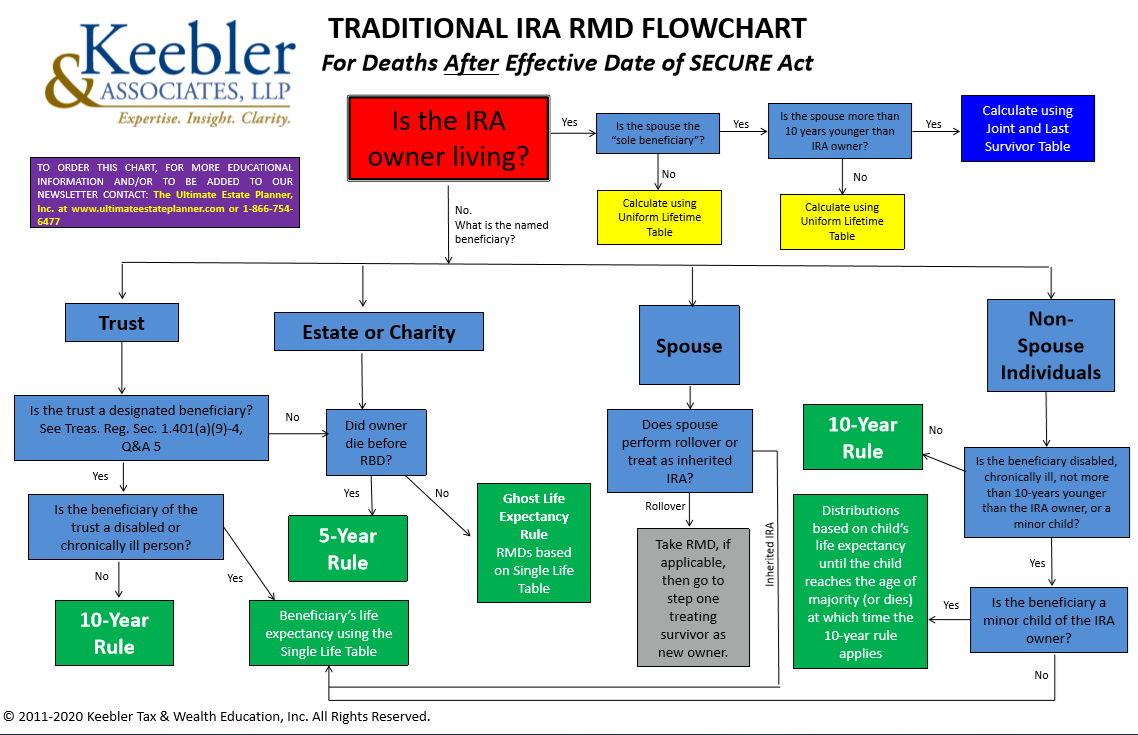

Designated Beneficiaries: To qualify for the lifetime RMD schedule, you must be a designated beneficiary, meaning you're a named beneficiary on the IRA account. Non-Designated Beneficiaries: If you're a non-designated beneficiary, such as a charity or estate, you'll be subject to the five-year rule, which requires the IRA to be fully distributed within five years of the account owner's passing. Spousal Beneficiaries: If you're the spouse of the deceased account owner, you have more flexibility with RMDs. You can choose to take RMDs over your lifetime or roll the IRA into your own name, allowing you to delay RMDs until you reach age 72.

Calculating RMDs

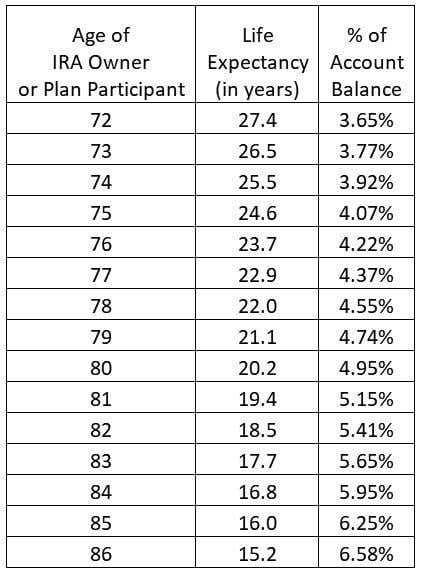

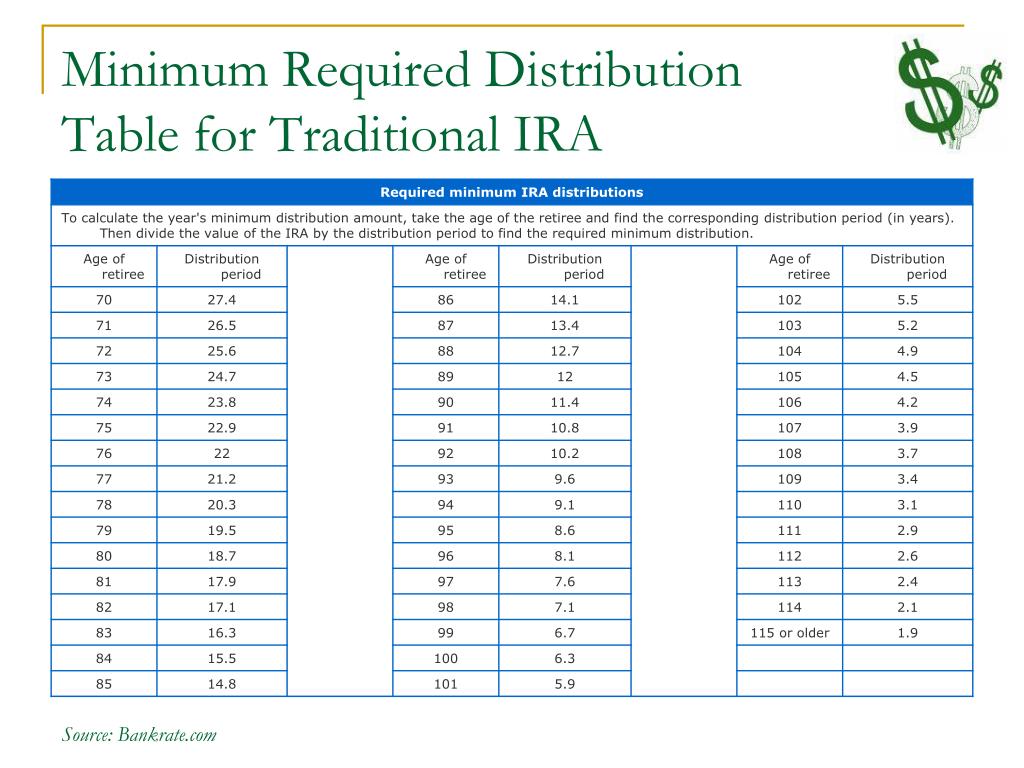

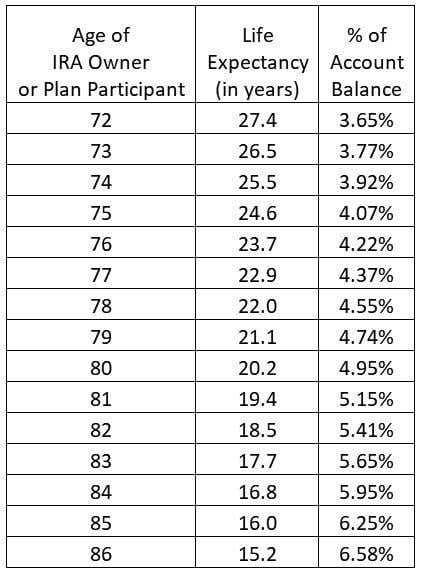

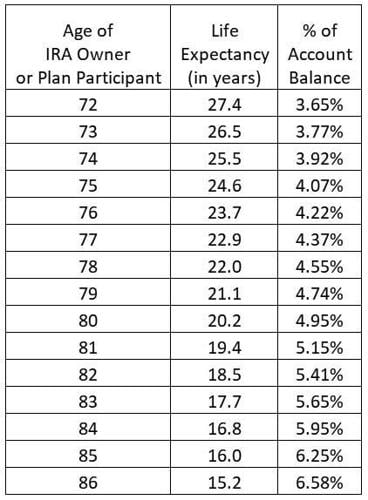

To calculate your RMD, you'll need to use the Single Life Expectancy table provided by the IRS. This table provides a life expectancy factor based on your age, which is then used to calculate your RMD. For example, if you're 50 years old and the IRA balance is $100,000, your RMD might be $2,000 (2% of the IRA balance).

Strategies for IRA Beneficiaries

Tax Planning: Consider the tax implications of your RMDs and plan accordingly. You may want to take distributions in years when your income is lower to minimize taxes. Investment Strategy: Rebalance your inherited IRA to ensure it aligns with your investment goals and risk tolerance. Charitable Giving: If you don't need the RMD for living expenses, consider using it for charitable giving, which can provide tax benefits. In conclusion, understanding required minimum distributions for IRA beneficiaries is crucial to avoiding penalties and making the most of your inherited assets. By grasping the key concepts, rules, and strategies outlined in this article, you'll be better equipped to navigate the complex world of RMDs and ensure a secure financial future.Word count: 500