The world of finance is filled with intriguing terms and phenomena, each with its own unique characteristics and implications for investors. One such phenomenon that has garnered significant attention is the "dead cat bounce." This term, though morbid in its origin, has become a crucial concept in understanding market dynamics, particularly in the context of stock prices and financial analysis. In this article, we will delve into the concept of the dead cat bounce, its origins, and its relevance in the financial world.

Origins of the Term

The term "dead cat bounce" originates from a rather gruesome analogy. It suggests that even a dead cat will bounce if dropped from a great height. Similarly, in finance, a dead cat bounce refers to a brief and slight recovery in the price of a stock or other asset after a significant decline. This recovery, however, is short-lived and does not signify a genuine turnaround in the asset's value. The term is used to caution investors against interpreting a brief rebound as a sign of a larger recovery, which might not materialize.

Characteristics of a Dead Cat Bounce

A dead cat bounce is characterized by a few distinct features:

-

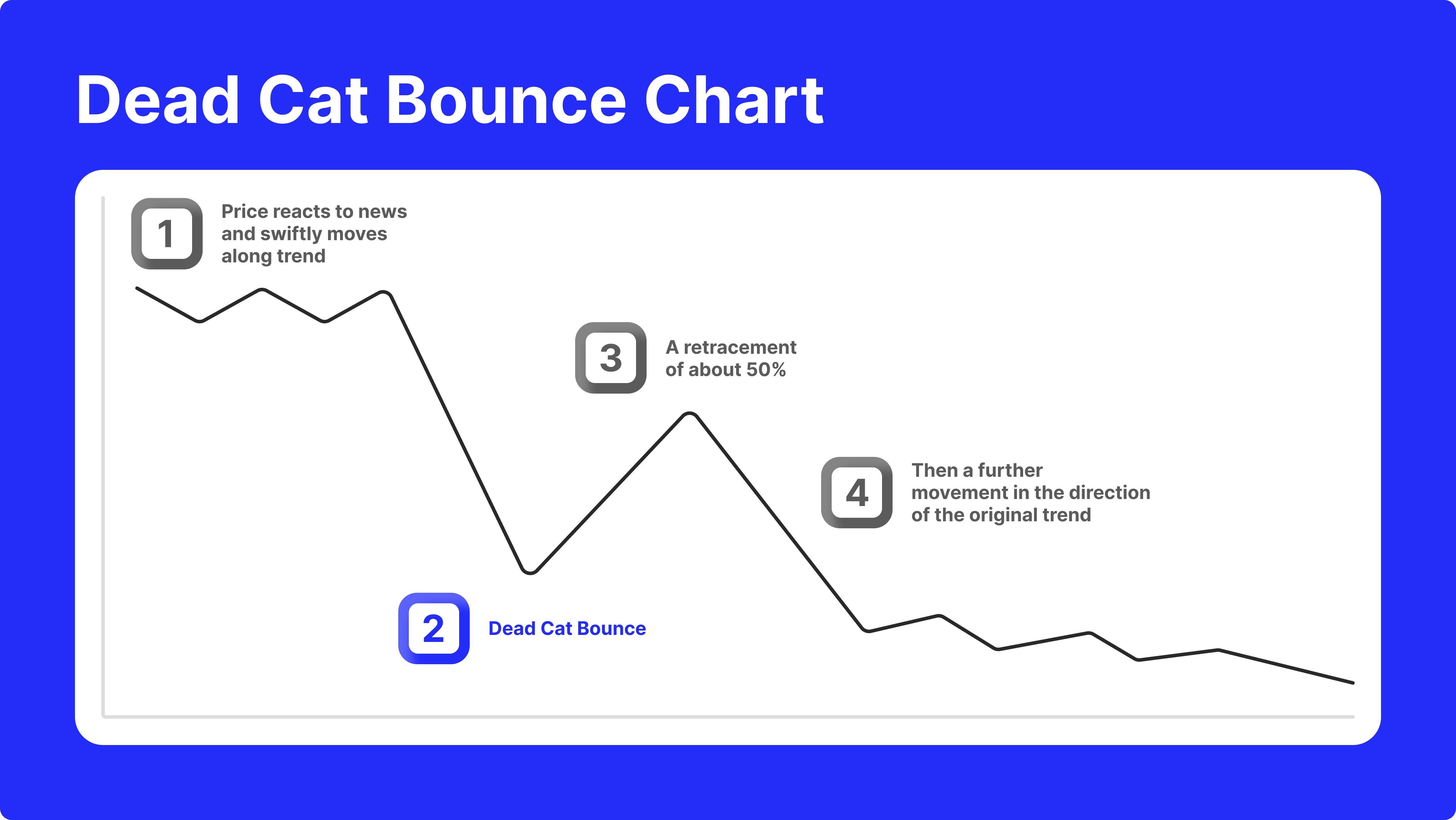

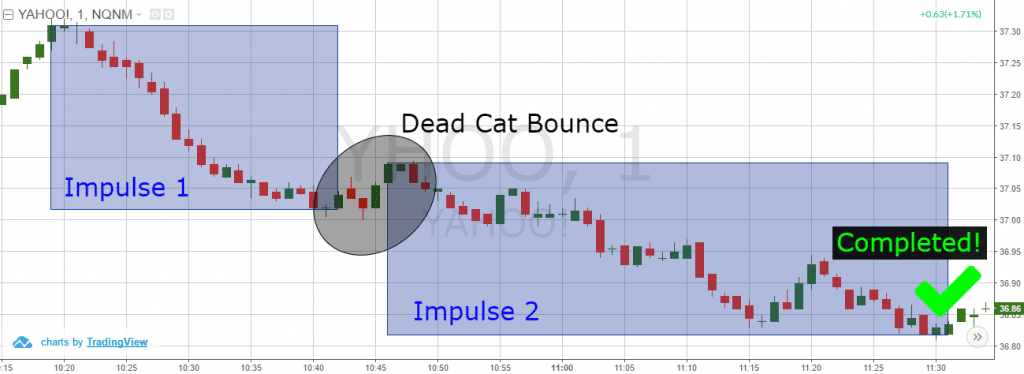

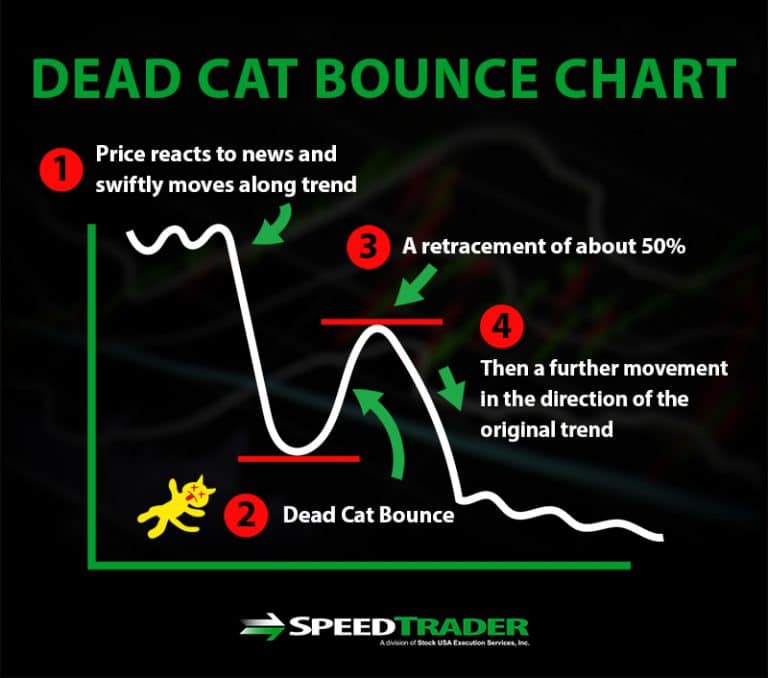

Sudden and Significant Decline: It follows a sharp decline in the price of a stock or asset.

-

Brief Recovery: There is a brief and slight increase in the price after the decline.

-

Lack of Sustenance: The recovery is short-lived and fails to gain momentum, eventually leading to further decline.

-

No Fundamental Change: The bounce is not backed by any significant positive change in the company's fundamentals or market conditions.

Relevance in Financial Analysis

Understanding the concept of a dead cat bounce is crucial for investors and financial analysts. It helps them differentiate between a genuine recovery and a temporary fluctuation. Here are a few reasons why recognizing a dead cat bounce is important:

-

Investment Decisions: Investors can avoid buying into a stock that has experienced a dead cat bounce, thinking it's a sign of recovery, only to see the price drop again.

-

Risk Management: Identifying a dead cat bounce can help in managing risk. Investors can use this knowledge to decide whether to hold onto a stock, sell, or short it, depending on their strategy.

-

Market Analysis: It provides insight into market sentiment and can be a tool for technical analysis, helping analysts predict future price movements.

The dead cat bounce is a fascinating financial phenomenon that, despite its gruesome origin, offers valuable lessons for investors and analysts. By understanding the characteristics and implications of a dead cat bounce, individuals can make more informed investment decisions and navigate the complex world of finance with greater ease. Whether you're a seasoned investor or just starting to explore the markets, recognizing the signs of a dead cat bounce can be a crucial skill in your financial toolkit.

In the ever-volatile financial markets, knowledge is power. The dead cat bounce serves as a reminder that not all recoveries are created equal, and discerning between a genuine turnaround and a fleeting bounce can be the difference between profit and loss. As the financial landscape continues to evolve, understanding such phenomena will remain essential for those looking to succeed in the world of investments.

Remember, in the financial world, even the most unusual terms can hold significant wisdom. The dead cat bounce, with its unique blend of morbid humor and financial insight, stands as a testament to the complexities and nuances of the market, waiting to be understood and leveraged by those keen to navigate its twists and turns.