Understanding the U.S. Dollar Index (DXY): A Key Indicator for Forex Markets

BlogTable of Contents

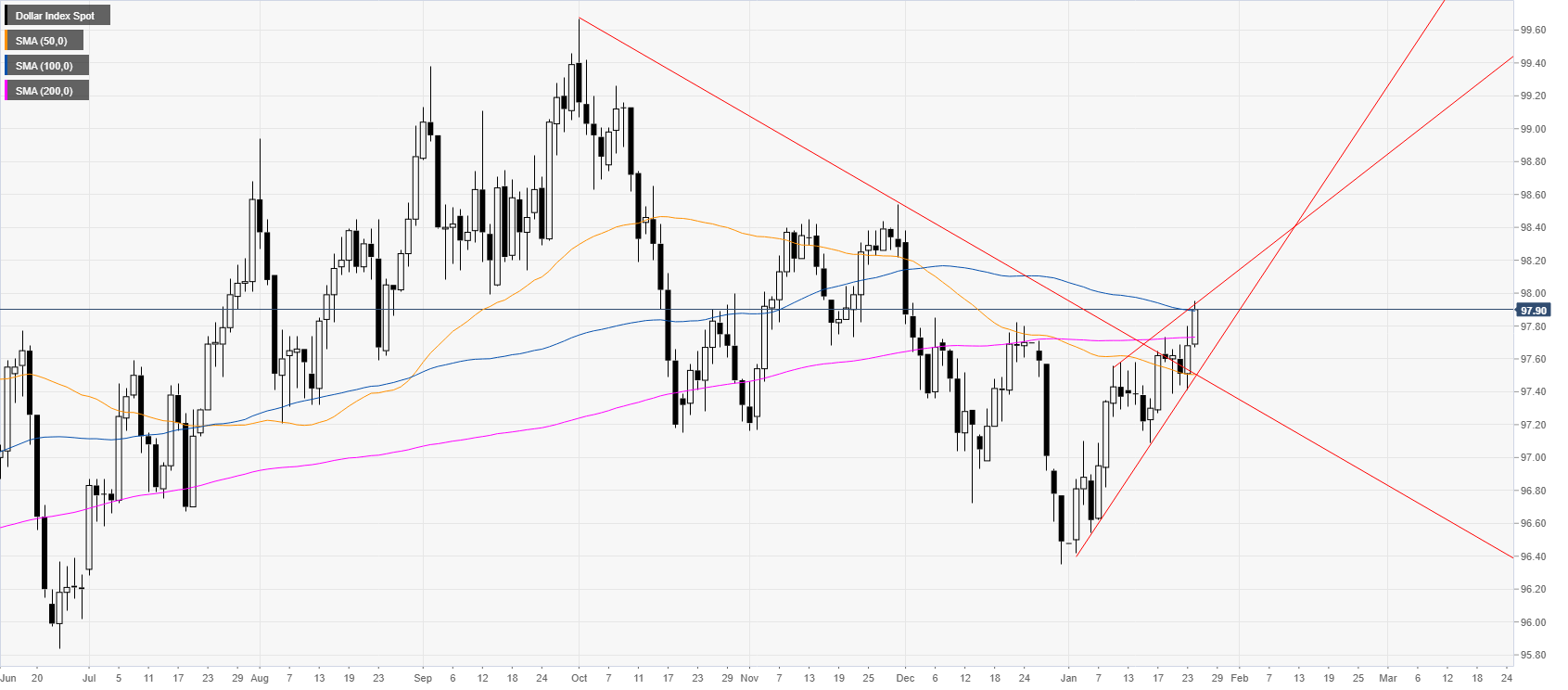

- US Dollar Index (DXY) Technical Outlook: Support Growing in Importance

- DXY Chart — USD Currency Index Quote — TradingView

- Dollar Index Chart - DXY Quote — TradingView

- ดอลลาร์สหรัฐ (DXY) ไม่สนใจเฟด ตอนนี้โฟกัสไปที่ NFP - THAIFRX.com

- DXY Explained: What the US Dollar Index is and How it Will Affect You ...

- DXY Index Stays Lower after Currency Markets Flash Crash

- DXY: US Dollar Index: Fundamental Analysis and Review

- US Dollar Index Price Analysis: DXY nearing two-month's highs, eyeing ...

- U.S. Dollar Index Chart — DXY Quotes — TradingView — India

- 🅱🄰🆁🅺🆆🄾🆁🆃🅷 ™ on Twitter: "$DXY First entries of a count in progress ...

Composition of the DXY

How is the DXY Calculated?

Significance of the DXY

The DXY is a widely followed indicator in the Forex market, and it has several implications for traders and investors. Here are a few reasons why the DXY is important: Indicator of U.S. Dollar Strength: The DXY is a measure of the U.S. dollar's strength against a basket of major currencies. A rising DXY indicates a strong U.S. dollar, while a falling DXY indicates a weak U.S. dollar. Forex Market Trends: The DXY can influence trends in the Forex market. A strong DXY can lead to a rise in the value of the U.S. dollar against other currencies, while a weak DXY can lead to a decline in the value of the U.S. dollar. Economic Indicator: The DXY can also be an indicator of the overall health of the U.S. economy. A strong DXY can indicate a strong U.S. economy, while a weak DXY can indicate a weak U.S. economy. In conclusion, the U.S. Dollar Index (DXY) is a crucial indicator in the Forex market, measuring the value of the U.S. dollar against a basket of six major foreign currencies. Understanding the DXY and its implications can help traders and investors make informed decisions in the Forex market. Whether you are a seasoned trader or just starting out, it is essential to keep an eye on the DXY and its movements to stay ahead of the curve in the Forex market.For more information on the DXY and other Forex market indicators, visit MarketWatch for the latest news and updates.

Note: This article is for informational purposes only and should not be considered as investment advice. Trading in the Forex market involves risk, and it is essential to do your own research and consult with a financial advisor before making any investment decisions.