The world of exchange-traded funds (ETFs) has gained significant traction in recent years, and one of the most popular options among investors is the Invesco QQQ ETF, commonly referred to as QQQ. As a fund that tracks the Nasdaq-100 Index, QQQ provides exposure to some of the largest and most innovative companies in the technology and growth sectors. In this article, we will delve into the QQQ ETF stock price and provide an overview of its performance, benefits, and investment potential.

What is QQQ ETF?

The Invesco QQQ ETF is an exchange-traded fund that aims to track the performance of the Nasdaq-100 Index, which comprises the 100 largest and most actively traded non-financial stocks listed on the Nasdaq stock exchange. The fund was launched in 1999 and has since become one of the most popular and widely traded ETFs in the world. QQQ holds a portfolio of stocks that includes tech giants such as Apple, Microsoft, Amazon, and Google, as well as other growth-oriented companies.

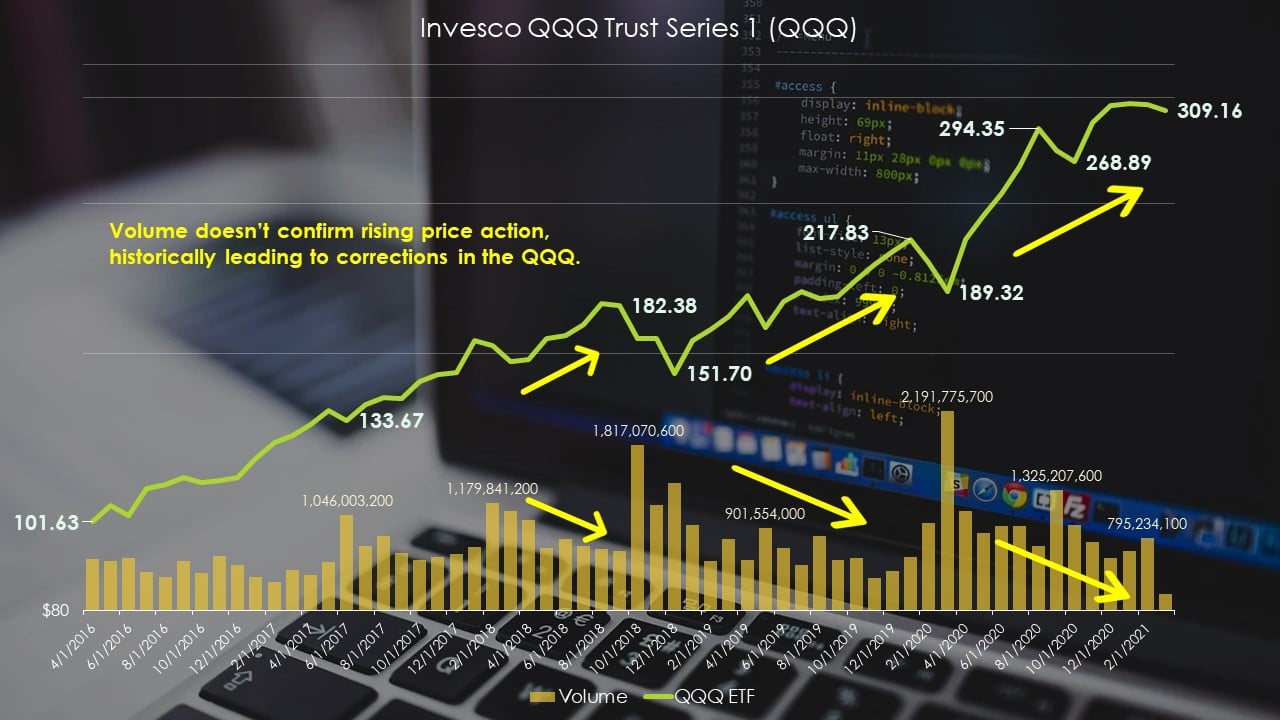

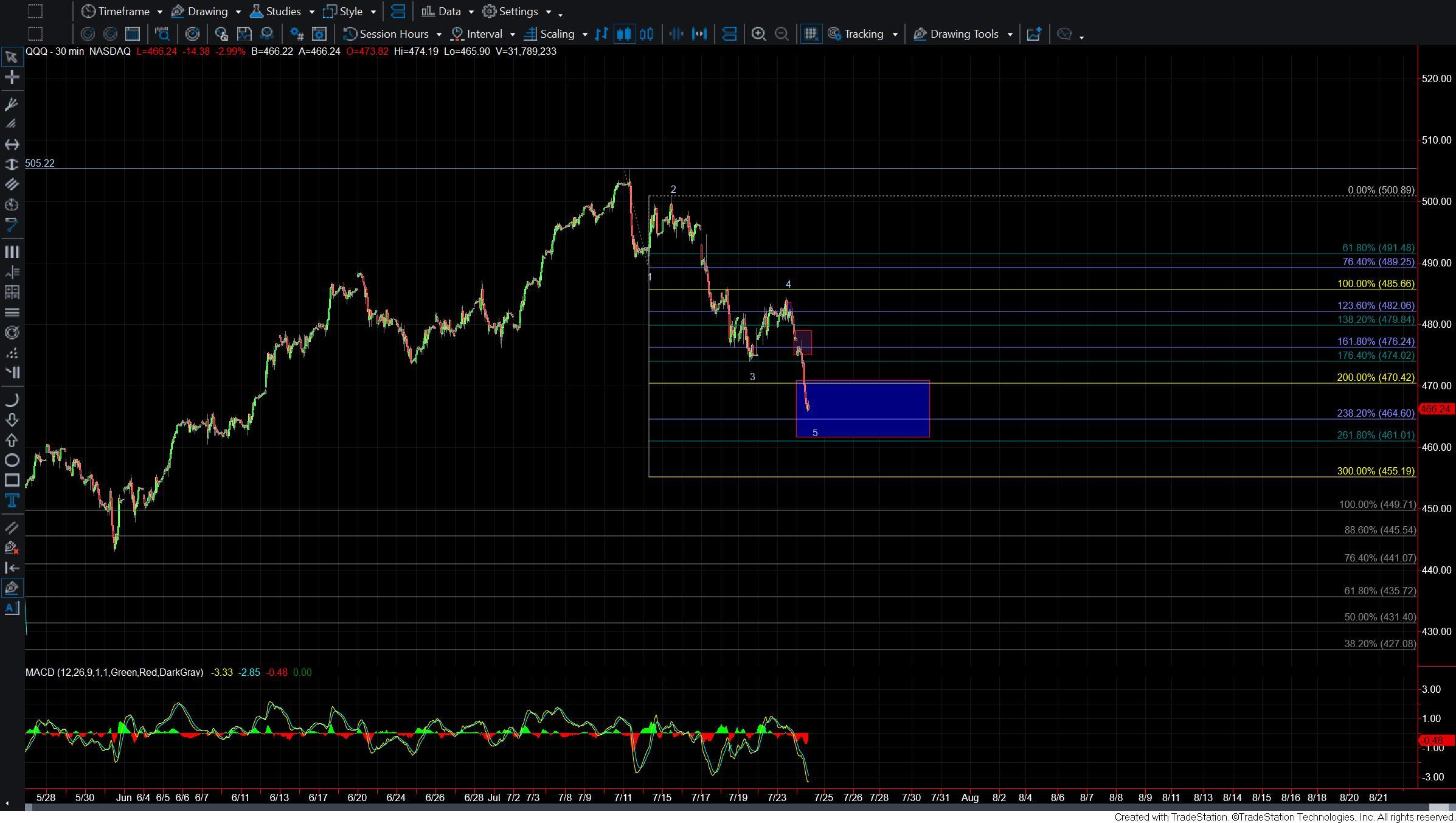

QQQ ETF Stock Price Performance

The QQQ ETF stock price has been on a remarkable upward trajectory over the past decade, driven by the strong performance of the underlying stocks in the Nasdaq-100 Index. As of [current date], the QQQ ETF stock price is trading at around [current price], with a 52-week range of [52-week range]. The fund has delivered impressive returns, with a 1-year return of [1-year return]% and a 5-year return of [5-year return]%.

Benefits of Investing in QQQ ETF

There are several benefits to investing in the QQQ ETF, including:

Diversification: By tracking the Nasdaq-100 Index, QQQ provides exposure to a broad range of stocks, reducing risk and increasing potential for long-term growth.

Convenience: QQQ is an ETF, making it easy to buy and sell shares on a stock exchange, just like individual stocks.

Low Costs: The fund has a relatively low expense ratio of [expense ratio]%, making it an attractive option for cost-conscious investors.

Tax Efficiency: As an ETF, QQQ is generally more tax-efficient than actively managed mutual funds, which can help minimize tax liabilities.

Investment Potential

The QQQ ETF has significant investment potential, driven by the growth prospects of the underlying stocks in the Nasdaq-100 Index. The fund's portfolio is heavily weighted towards technology and growth sectors, which are expected to continue driving innovation and disruption in the global economy. With its strong track record and diversification benefits, QQQ is an attractive option for investors seeking long-term growth and income.

In conclusion, the QQQ ETF is a popular and widely traded fund that offers investors exposure to some of the largest and most innovative companies in the world. With its strong performance, diversification benefits, and low costs, QQQ is an attractive option for investors seeking long-term growth and income. As the global economy continues to evolve and grow, the QQQ ETF is well-positioned to capitalize on the trends and opportunities that emerge. Whether you're a seasoned investor or just starting out, QQQ is definitely worth considering as part of a diversified investment portfolio.

Note: The information contained in this article is for general information purposes only and should not be considered as investment advice. Investors should consult with a financial advisor or conduct their own research before making any investment decisions.