US Inflation Sees a Slight Dip, But Trade War Looms as a Potential Threat

BlogTable of Contents

- 物聯網應用實例 - BTCC 熱門知識

- CPI Data Tomorrow - Apollo Academy

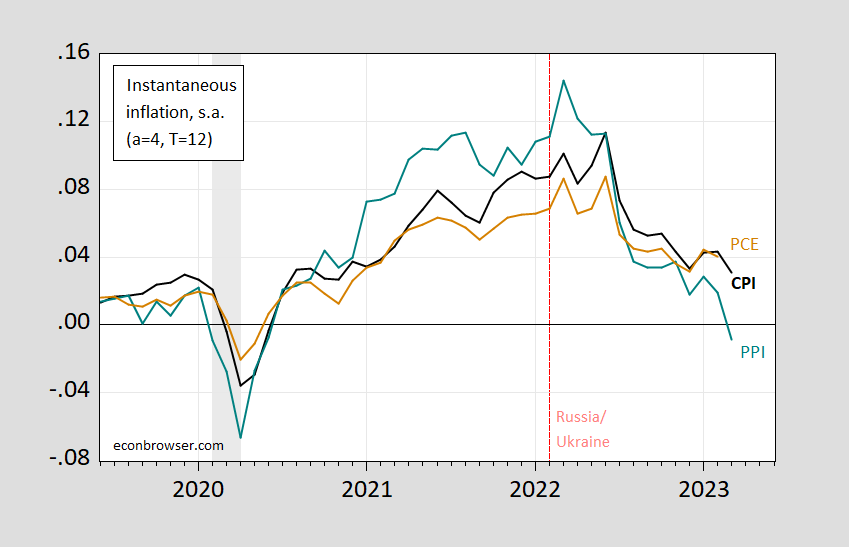

- CPI, PPI, and PCE Instantaneous Inflation | Econbrowser

- What’s in the Core of the CPI? – Political Arithmetick

- Không thể chủ quan dù CPI tháng 8 được "hãm phanh", mục tiêu kiểm soát ...

- CPI là gì? Ý nghĩa và công thức tính chỉ số giá tiêu dùng CPI

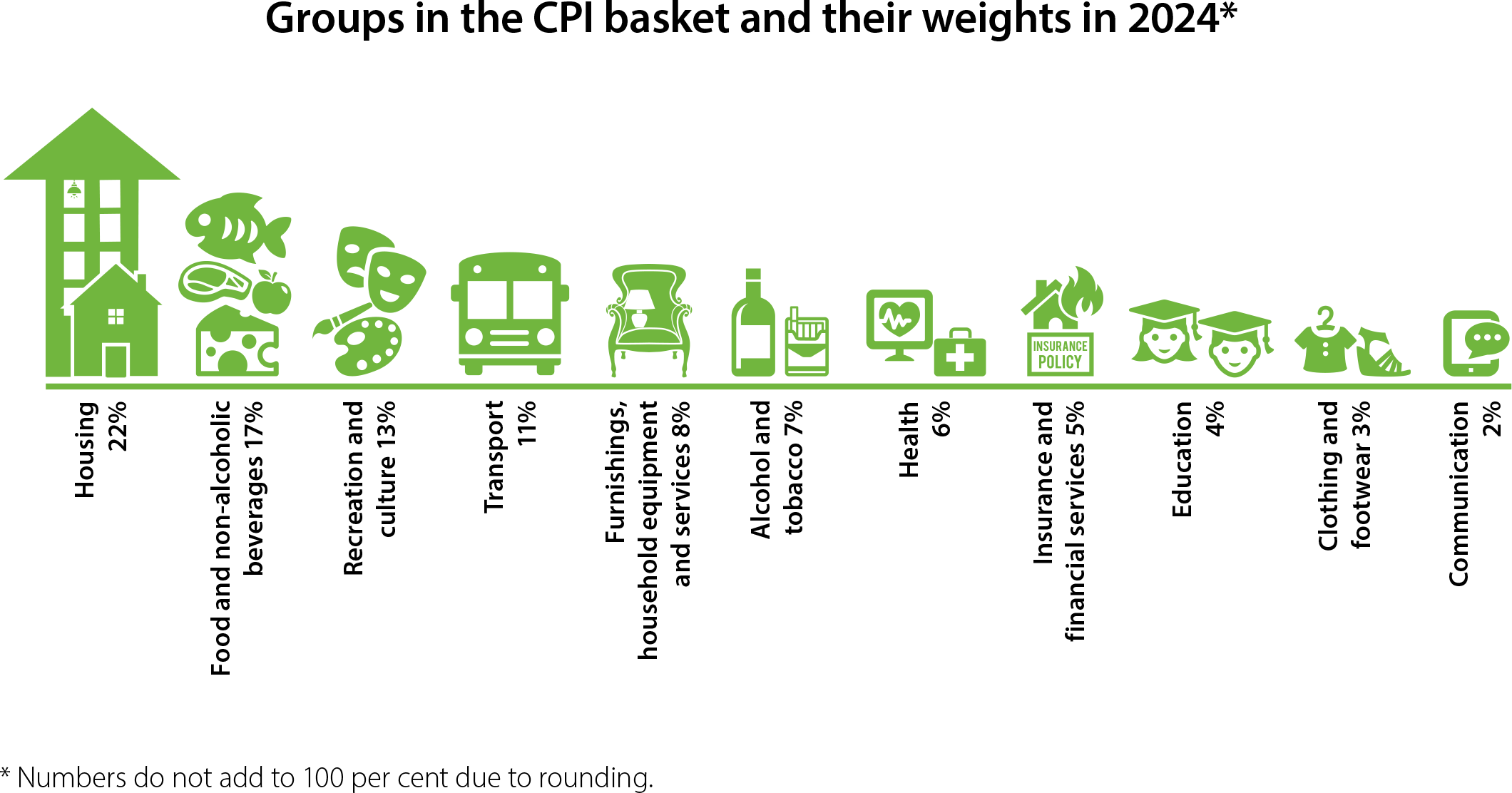

- What's your real inflation rate? - Morningstar.com.au

- Us Cpi Release Dates 2025 - Mia Ann

- CPI Mỹ tăng 6% so với cùng kỳ, khớp với dự báo | Fili

- Pentingnya Data CPI dalam Perdagangan Emas - TPFx

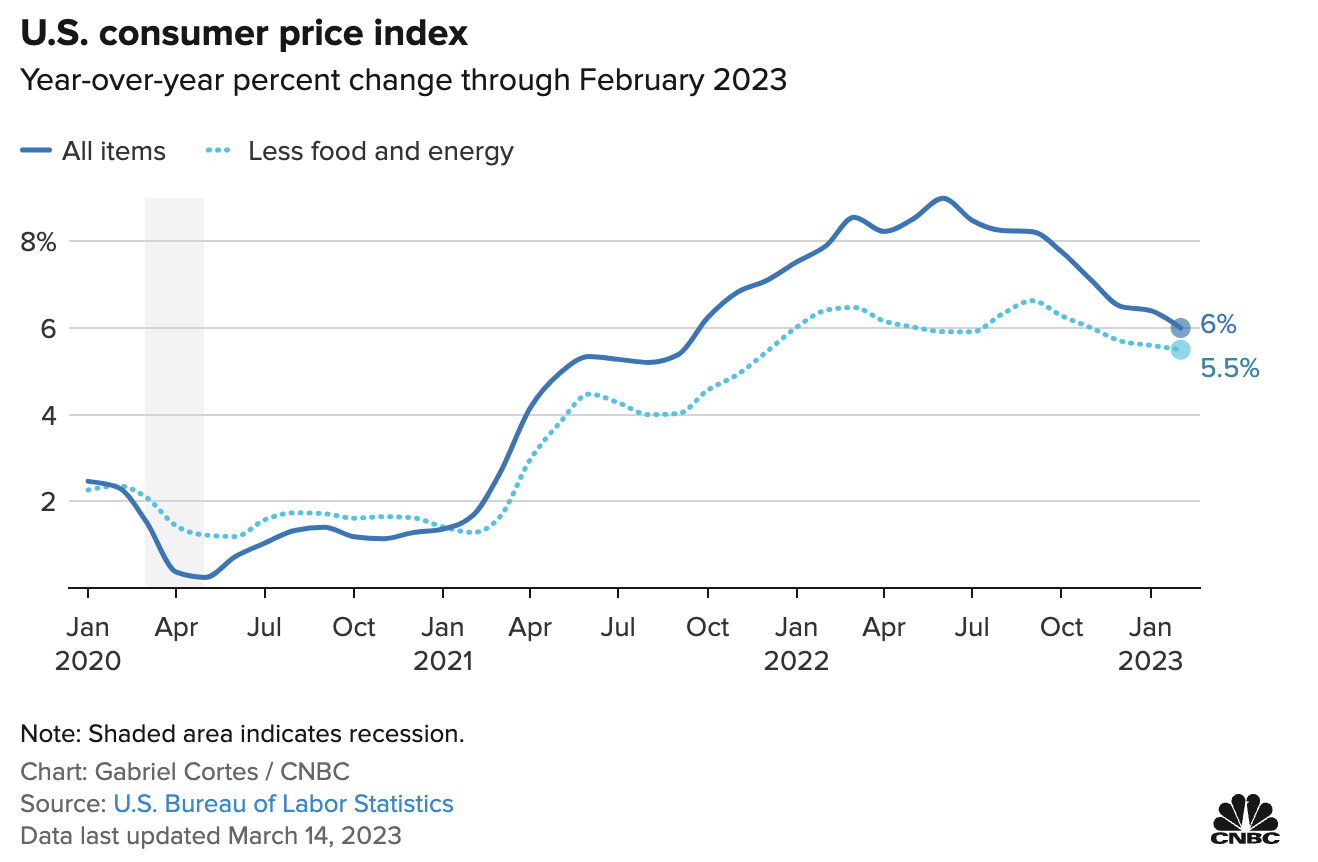

The Consumer Price Index (CPI), which measures the average change in prices of a basket of goods and services, rose by 2.3% in August compared to the same period last year. This is a slight decrease from the 2.5% increase recorded in July. The core CPI, which excludes volatile food and energy prices, also saw a marginal decline, increasing by 2.0% compared to 2.2% in the previous month. These numbers indicate that inflation is still within the Federal Reserve's target range of 2%, but the trade war with China could potentially push prices up in the coming months.

Impact of Trade War on Inflation

The trade war has also led to a decline in business confidence, with many companies delaying investments and hiring due to uncertainty about the future. This could lead to a slowdown in economic growth, which in turn could impact inflation. The Federal Reserve has already cut interest rates twice this year to boost economic growth, but the trade war poses a significant risk to the economy, and the Fed may need to take further action to mitigate its impact.

What's Next for the US Economy?

In conclusion, while the US inflation has cooled down last month, the trade war with China poses a significant threat to the economy. The impact of the trade war on inflation and economic growth will be closely watched in the coming months, and the Federal Reserve will need to take a cautious approach to monetary policy to mitigate its effects. As the trade war continues to evolve, it's essential for consumers, investors, and businesses to stay informed about the latest developments and their potential impact on the economy.